Meet Pro features: Volatility Smile, predefined Options Strategies, and OCO orders

Navigation

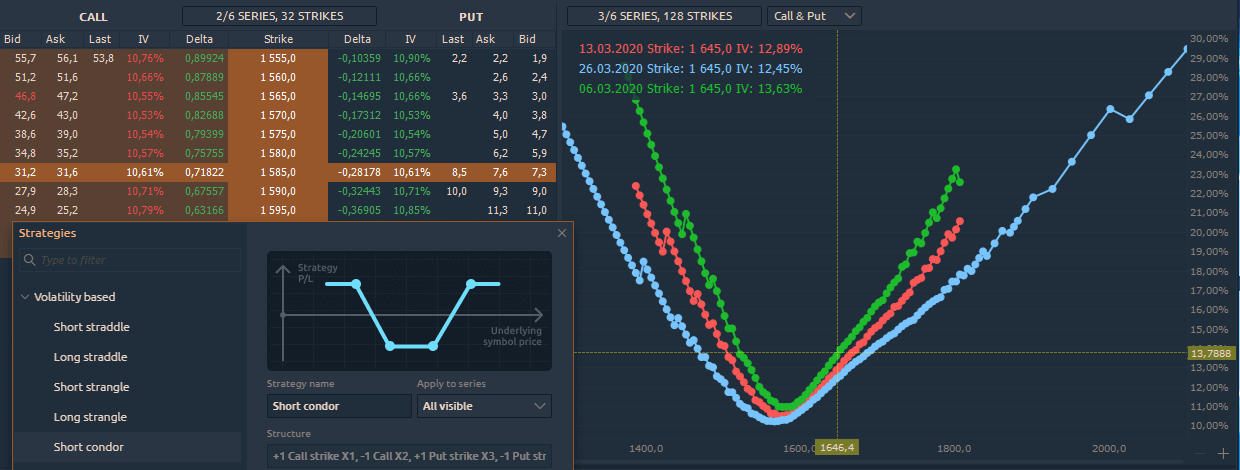

37 Predefined Options Strategies

In this release, we improved the Option Analytics panel by adding a list of 37 predefined option strategies that you can apply for analysis or trading with one click. For convenience, all strategies are divided into 4 categories:

- Up Trend

- Down Trend

- Volatility Based

- Arbitrage strategies

For each strategy, you can see a general risk profile scheme, description, and structure, i.e. what options (Call or Put) it consists of. Once you have selected the desired strategy from the list, click on the "Add Strategy" button and it will appear in the bottom table "Test & Real Positions". In this table, you can analyze several strategies at once, simply ticking off the necessary strikes.

It is important to note that all option strategies are built on the strikes closest to ATM (at-the-money). To extend the strategy profile, you need to manually add the necessary strikes via the Paper column in the options desk.

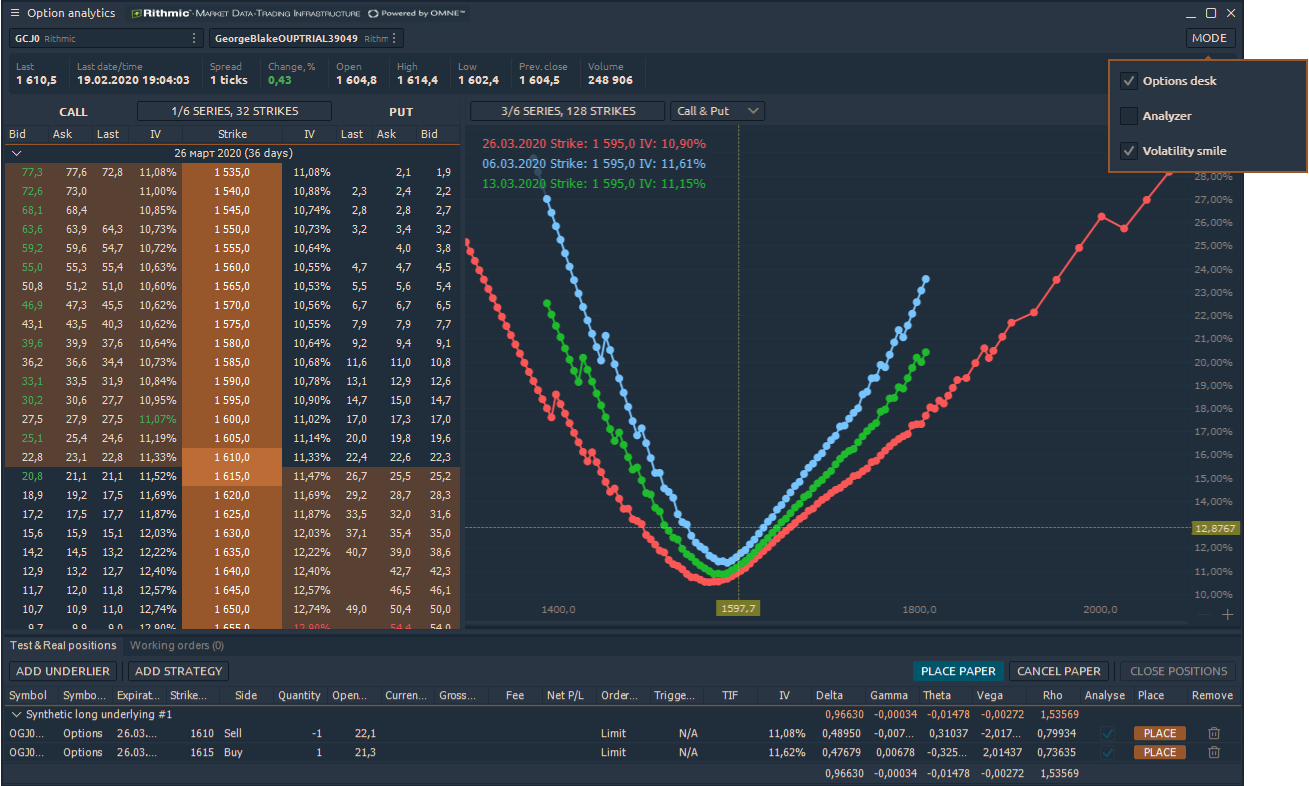

Volatility Smile chart

Another improvement that we added to the Option Analytics panel is the Volatility Smile chart. It shows the implied volatility values for all strikes on the same line. This allows you to compare the value of options and understand is their overbought or oversold relative to each other.

Cumulative Last Trade Size in DOM Trader

Changed the display of the Last Trade Size, which was located on the price axis. In the new version, we placed Last Trade Size in a separate column and added a mechanism for accumulating trading volume, if the price did not change.

For example, if the previous trade was on the Bid side, and then the latest trade is on the Ask side at the same price, then the Last Trade Size will add the value. But if the price will change on one tick up or down, then the Last Trade Size will be reset.

Added OCO orders for Rithmic connection

In the last release, we have already added Bracket Orders, which allow you to reduce losses in case of an unfavorable trade. Today we present OCO orders (One Cancels Other), which is a widely known and popular order type among traders. Using the trading functionality of the Quantower platform, you can set two independent limit orders and combine them into an OCO group. When one of the orders is executed, the second will be automatically canceled.

Additionally, for each limit order, you can set Bracket orders (SL and TP) and then merge them into a group.

As ever, we’d love to hear what you think about Quantower, your feedback helps us improve whole the platform. Keep an eye out for future updates!

Comments